Highlights of Dexter’s March 2024 report

5% fewer homes sold in Greater Vancouver compared to March 2023

15% more homes were listed for sale compared to March 2023

Spring Break turned into a real estate break

Burnaby North sees a surge in new condo listings

Spring break took some of the life out of the real estate market this year, especially with Easter at the end. At the mid-point of the month, there were 3,000 new listings which was on target to bring on 6,000 for the first time since the spring of 2022. With only 5,112 at the end of March, it appears a break was indeed what many took. That 6,000 number could come in April though as this pent-up real estate market continues to simmer with many waiting to act. Buyers were also more absent in the last half as the month finished with 2,415 sales – down from the 2,535 sales in March 2023. At the mid-point of March, there were 1,300 sales, the last half decline was evident in the final numbers. Expect buyers and sellers to get back to the market with more urgency with April upon us.

The wait continues for the next Bank of Canada announcement on April 10th which will yield no changes to their rate which affects variable rate mortgages. It will be the tone of the announcement that will play into how the market reacts. With June or July being the first potential rate cut according to many economists, the tone from the Bank of Canada will continue to be the most important part of the announcements. Economic data on inflation and the health of the economy play into the Bank of Canada’s decision on changes to their rate. Signs had been pointing to a rate cut sooner rather than later but with the Canadian GDP showing stronger numbers in February, that may not rush a decision to lower rates. With revised inflation and economic forecasts coming at the April meeting, we’ll get a better sense of when rates will start to come down.

On April 16 the federal government will release their annual budget. What housing initiatives will come with that budget this year? The Liberal Government has already come out talking about launching a renter’s bill of rights. With housing continually on the minds of the government right now and without any recent government policies showing any ability to tame the market, it will be interesting to see if anything else comes from this budget. The provincial government announced its much talked about anti-flipping tax during their budget this year as governments continue their assault on demand. And this week, the NDP government in B.C. strengthened restrictions on landlord use of property evictions. With more than one million people coming to Canada in each of the last two years, supply is where the focus needs to be. With recent reports stating that 741,000 new homes are needed each year through 2030, and with just 223,000 housing starts in 2023, recent government policy only serves to decrease supply and limit investor involvement. And without that capital, fewer homes will be built for renters and owners.

There were 2,415 properties sold in Greater Vancouver in March after seeing 2,070 properties sold in February, and 1,427 properties sold in January this year. This was a 5% decrease from the 2,535 properties sold last year in March. After the first quarter of 2024, sales are up 9.7% compared to the first 3 months of 2023. With Easter at the end of spring break this year, the effects from the school break were felt to a greater degree. Both sales and new listings fell back after mid-month with buyers and sellers focussed on other things. Since the middle of February, the number of sales per day have been consistent rising from 116 in the latter half of February to 120 per day in March. Albeit not quite the increase you’d expect in a spring market.

With March sales down from last year, this translated into sales being 30% below the 10-year-average after they were 23% below the 10-year-average in February, and 22% below the 10-year average in January. With demand still showing signs of waiting for rate changes in buyers’ favour, activity levels are on the lower side. While multiple offers are occurring in the marketplace, it’s very much dependent on how many are listed around it, where the property is and how it is priced. Detached homes and townhomes are the most popular and shortest in supply, so it’s not surprising to see multiple offers occurring more so with those segments. April could see more buyers focus on the market with spring break and Easter out of the way, and a closer path to interest rates coming down – if the economy cooperates.

With the increased sales in March compared to the previous month, we saw a drop to 4 months supply of homes overall in Greater Vancouver, falling from 5 months in February and 6 months in January. Technically this makes it a seller’s market – although we’ve seen this act before. Low inventories create an illusion of a true seller’s markets, but not for all properties. This could change if we see significantly more listings come on the market in April with there being nearly 2,000 more active listings now compared to a year ago. Vancouver’s West Side stayed at 6 months supply and Vancouver’s East Side stayed at 4 months (a technical seller’s market) even with a surge in listings over the last year. The growth in new listings year-over-year was slower in Vancouver with sales near the same levels as March 2023 (although detached sales on Vancouver’s West Side were down 31% year-over-year and down 3% month-over-month). North Vancouver continues at 3 months supply with its perpetually low inventory, and Burnaby remains at 3 months, except in Burnaby North where 5 months supply is available because of over 100 new listings for brand new and recently completed condos at Lougheed Mall and around Brentwood. Port Moody finished with nearly half the sales of March 2023 and bumped up to 4 months supply while Port Coquitlam had more sales and fewer new listings leaving that municipality with 2 months supply.

Even though it felt like more homes were coming on the market, there were only 5,112 new listings in Greater Vancouver. This was above last year’s total of 4,427 new listings, producing another consecutive month of year-over-year increase in new listings. After the first quarter in 2024, total new listings are 20% more than the first quarter of 2023. That is helping to add to the active listing count.

The number of new listings in March were 9% below the 10-year average after February was right at the 10-year average, taking us back to the previous few months which saw the level of new listings below the average. Whether spring break or playing the waiting game, some sellers just as much as buyers are holding off.

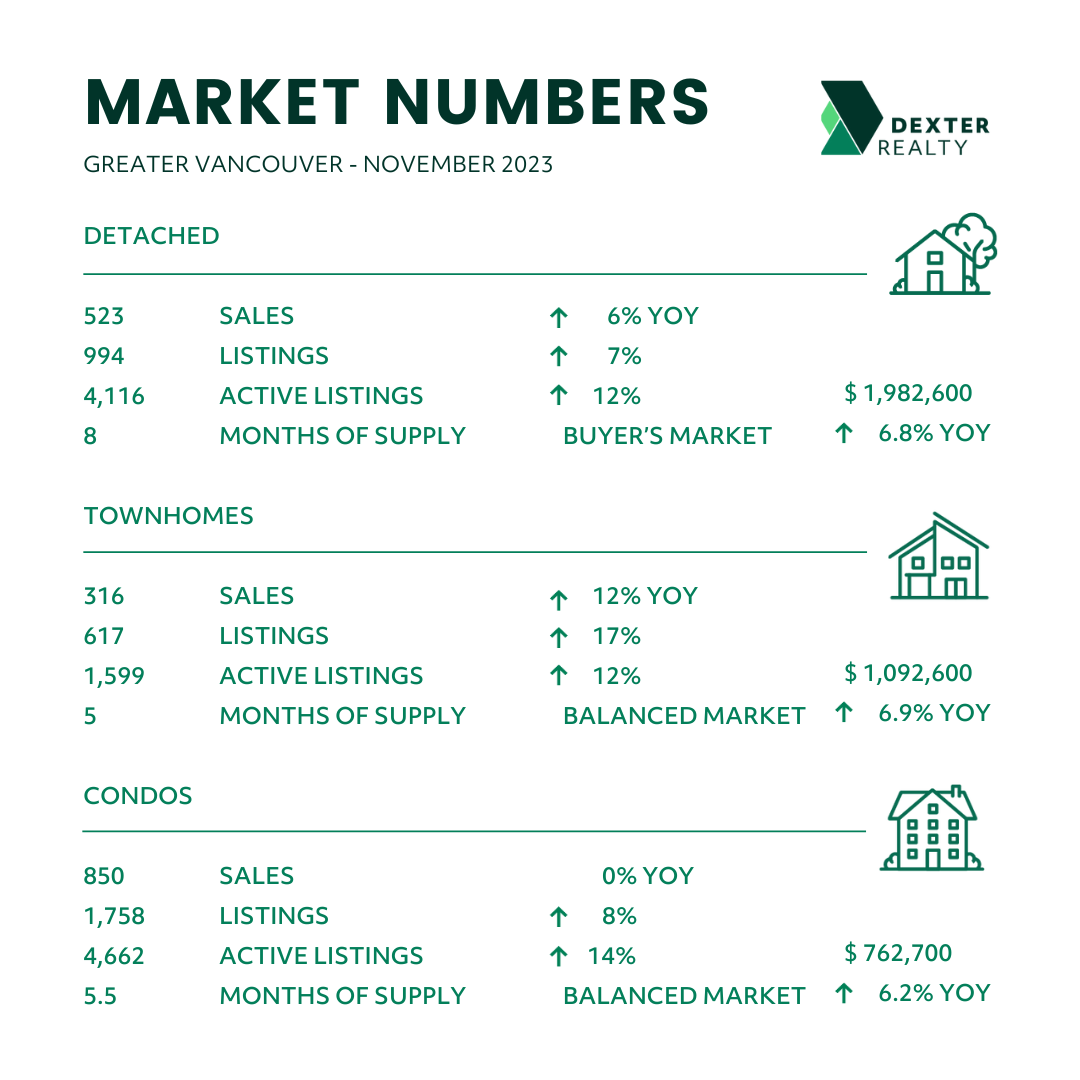

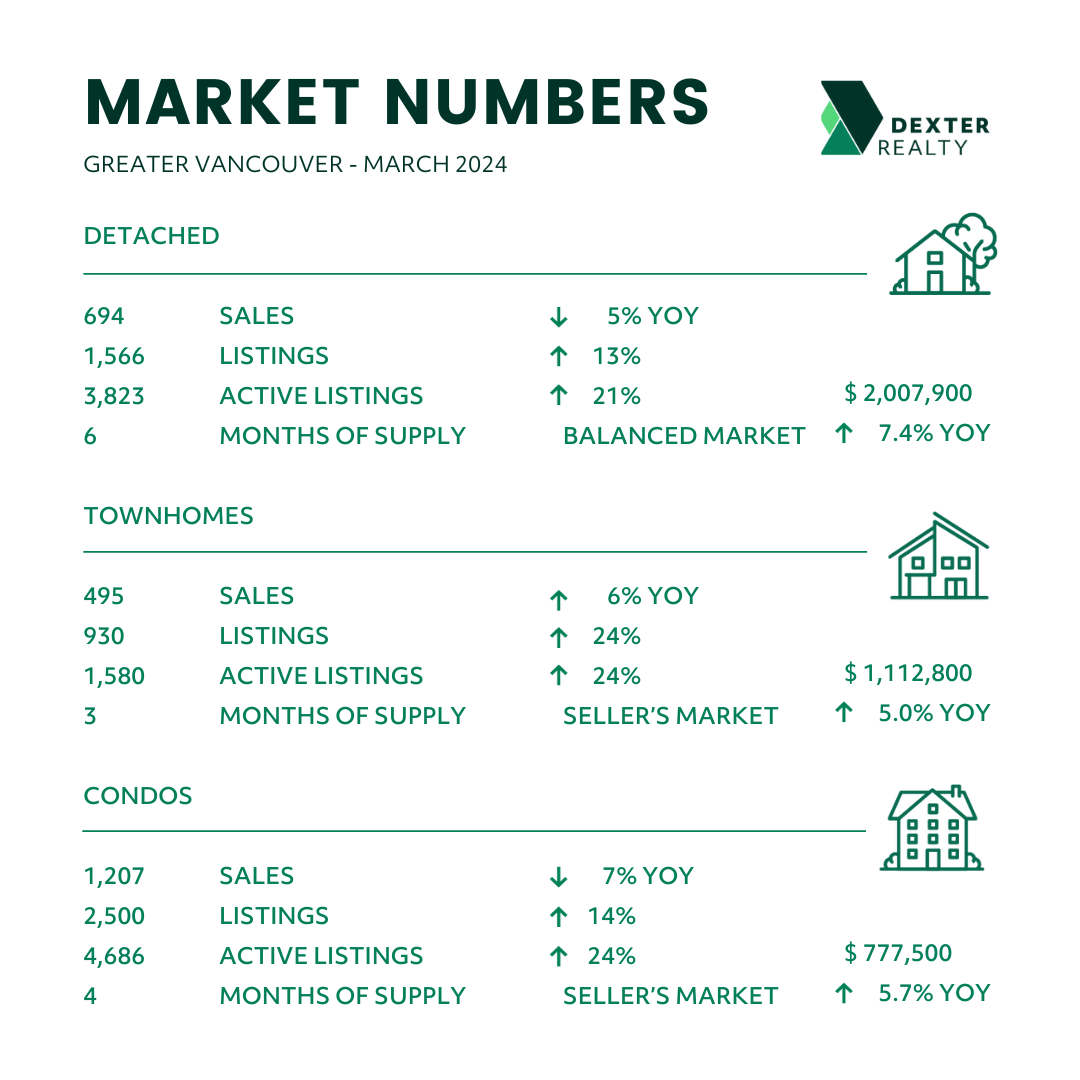

There were 10,552 active listings in Greater Vancouver at month end, compared to the 9,634 active at the end of February and 8,633 active listings at the end of January. The count of active listings is up year-over-year though, with there being nearly 2,000 more at the end of March compared to 8,617 at the end of March 2023. The detached market overall has come down to 5.5 months of supply from 6 in February and 8 in January, keeping it in a balanced market. Townhomes have dropped down to 3 months supply from 4 and condos stayed at 4 months supply - keeping both in seller’s market conditions. Even with the elevated supply of detached properties, year-over-year House Price Index was up 7.4%, compared with 5.0% for townhouses and 5.7% for condos. Land continues to be the best investment.

Depending on price point and area though, some may be more in balanced market conditions. Absorption rates for detached were up to 44% from 39% for the month while townhouses and condos were 53% and 48% from the previous month at 48% and 47% respectively. All segments saw lower absorption rates compared to last year in March, because of the increase in new listings this month and hence the subsequent rise in total active listings.

April is shaping up to be a bell weather month. With listing inventory ready to take off – 1,235 new listings within the first two days of April already, and buyers circling while waiting for the right time to jump in the market, it could produce a healthier pace of sales that sees buyers and sellers win. With limited inventory over the last 10 years, prices haven’t faced the downward pressure that would be expected with the slower pace of the market. The real estate market in Metro Vancouver has a long way to go to get to balance, but every listing helps. And with each new listings, comes another opportunity for the many buyers that are waiting.

Here’s a summary of the numbers:

Greater Vancouver: Total Units Sold in March were 2,415 - up from 2,070 (17%) in February, up from 1,427 (69%) in January, down from 2,535 (5%) in March 2023, down from 4,505 (46%) in March 2022, down from 5,843 (59%) in March 2021, down from 2,562 (6%) in March 2020, up from 1,745 (38%) in March 2019; Active Listings were at 10,552 at month end compared to 8,617 at that time last year and 9,634 at the end of February; New Listings in March were up 10% compared to February 2024, up 15% compared to March 2023, down 25% compared to March 2022, down 40% compared to March 2021, up 13% compared to March 2020, and up 1% compared to March 2019. Month’s supply of total residential listings is down to 4 month’s supply (seller’s market conditions) and sales to listings ratio of 47% compared to 45% in February 2024, 57% in March 2023, and 65% in March 2022. Month-over-month, the house price index is up 1.1% and in the last 6 months down 0.6%.

Vancouver Westside: Total Units Sold in March were 424 - up from 374 (13%) in February, up from 245 (73%) in January, down from 449 (6%) in March 2023, down from 800 (47%) in March 2022, down from 883 (52%) in March 2021, down from 467 (9%) in March 2020, up from 333 (27%) in March 2019; Active Listings were at 2,342 at month end compared to 1,977 at that time last year and 2,148 at the end of February; New Listings in March were up 4% compared to February 2024, up 5% compared to March 2023, down 28% compared to March 2022, down 34% compared to March 2021, up 15% compared to March 2020, and down 2% compared to March 2019. Month’s supply of total residential listings is steady at 4 month’s supply (balanced market conditions) and sales to listings ratio of 44% compared to 40% in February 2024, 49% in March 2023, and 59% in March 2022.

Sales for townhouses are up 34% year-over-year, while condo sales are down 3%. Month-over-month, the house price index is down 0.1% and in the last 6 months down 0.9%.

Vancouver East Side: Total Units Sold in March were 285 - up from 249 (14%) in February, up from 164 (74%) in January, down from 287 (1%) in March 2023, down from 497 (43%) in March 2022, down from 661 (57%) in March 2021, down from 297 (4%) in March 2020, up from 174 (64%) in March 2019; Active Listings were at 1,198 at month end compared to 899 (up 33%) at that time last year and 1,109 at the end of February; New Listings in March were up 9% compared to February 2024, up 30% compared to March 2023, down 23% compared to March 2022, down 41% compared to March 2021, up 29% compared to March 2020, and up 17% compared to March 2019. Month’s supply of total residential listings is steady 4 month’s supply (seller’s market conditions) and sales to listings ratio of 48% compared to 46% in February 2024, 62% in March 2023, and 68% in March 2022. Month-over-month, the house price index is up 1.2% and in the last 6 months down 1.5%.

North Vancouver: Total Units Sold in March were 187 - up from 163 (15%) in February, up from 117 (60%) in January, down from 215 (13%) in March 2023, down from 345 (46%) in March 2022, down from 470 (60%) in March 2021, down from 204 (8%) in March 2020, up from 165 (13%) in March 2019; Active Listings were at 523 at month end compared to 479 at that time last year and 489 at the end of February; New Listings in March were down 3% compared to February 2024, down 10% compared to March 2023, down 32% compared to March 2022, down 53% compared to March 2021, down 7% compared to March 2020, and down 15% compared to March 2019. Month’s supply of total residential listings is steady at 3 month’s supply (seller’s market conditions) and sales to listings ratio of 56% compared to 48% in February 2024, 58% in March 2023, and 71% in March 2022.

Detached new listings were down 26% year-over-year, with townhomes and condos at 2 months supply. Month-over-month, the house price index is up 1.7% and in the last 6 months up 0.4%.

West Vancouver: Total Units Sold in March were 53 - down from 56 (5%) in February, up from 23 (130%) in January, down from 64 (17%) in March 2023, down from 87 (39%) in March 2022, down from 148 (64%) in March 2021, down from 56 (5%) in March 2020, up from 34 (56%) in March 2019; Active Listings were at 560 at month end compared to 463 at that time last year and 526 at the end of February; New Listings in March were up 10% compared to February 2024, up 15% compared to March 2023, up 2% compared to March 2022, down 36% compared to March 2021, up 12% compared to March 2020, and up 12% compared to March 2019. Month’s supply of total residential listings is up to 11 month’s supply (buyer’s market conditions) and sales to listings ratio of 28% compared to 33% in February 2024, 39% in March 2023, and 47% in March 2022.

Month-over-month, the house price index is up 2.3% and in the last 6 months down 3.9%.

Richmond: Total Units Sold in March were 279 - up from 231 (21%) in February, up from 161 (73%) in January, down from 352 (21%) in March 2023, down from 557 (50%) in March 2022, down from 768 (64%) in March 2021, down from 337 (17%) in March 2020, up from 178 (44%) in March 2019; Active Listings were at 1,166 at month end compared to 1,049 at that time last year and 1,088 at the end of February; New Listings in March were up 19% compared to February 2024, up 16% compared to March 2023, down 38% compared to March 2022, down 49% compared to March 2021, up 6% compared to March 2020, and down 18% compared to March 2019. Month’s supply of total residential listings is down to 4 month’s supply (seller’s market conditions) and sales to listings ratio of 50% compared to 50% in February 2024, 74% in March 2023, and 63% in March 2022.

Townhomes are down to 3 month’s supply with new listings for that segment down 14% year-over-year. Slow growth in active listings in this municipality. Month-over-month, the house price index is up 1.6% and in the last 6 months down 0.6%.

Burnaby East: Total Units Sold in March were 32 - up from 25 (28%) in February, up from 17 (88%) in January, up from 20 (60%) in March 2023, down from 56 (43%) in March 2022, down from 70 (54%) in March 2021, up from 27 (19%) in March 2020, up from 17 (88%) in March 2019; Active Listings were at 101 at month end compared to 85 at that time last year and 94 at the end of February; New Listings in March were down 12% compared to February 2024, up 13% compared to March 2023, down 21% compared to March 2022, down 48% compared to March 2021, up 10% compared to March 2020, and up 4% compared to March 2019. Month’s supply of total residential listings is down to 3 month’s supply (seller’s market conditions) and sales to listings ratio of 60% compared to 42% in February 2024, 43% in March 2023, and 84% in March 2022.

Condo sales double year-over-year with active listings totals down from February leaving 2 months supply. Month-over-month, the house price index is up 3.6% and in the last 6 months up 2.2%.

Burnaby North: Total Units Sold in March were 109 - down from 121 (10%) in February, up from 88 (23%) in January, down from 169 (36%) in March 2023, down from 257 (58%) in March 2022, down from 335 (67%) in March 2021, down from 130 (16%) in March 2020, up from 77 (42%) in March 2019; Active Listings were at 535 at month end compared to 388 at that time last year and 447 at the end of February; New Listings in March were up 22% compared to February 2024, up 28% compared to March 2023, down 14% compared to March 2022, down 32% compared to March 2021, up 37% compared to March 2020, and up 36% compared to March 2019. Month’s supply of total residential listings is up to 5 month’s supply (balanced market conditions) and sales to listings ratio of 36% compared to 49% in February 2024, 73% in March 2023, and 65% in March 2022.

Sales are down year-over-year and month-over-month, with condo active listings up 58% year-over-year. City of development! Month-over-month, the house price index is up 1.3% and in the last 6 months up 0.1%.

Burnaby South: Total Units Sold in March were 142 - up from 109 (30%) in February, up from 102 (39%) in January, up from 130 (9%) in March 2023, down from 213 (33%) in March 2022, down from 325 (56%) in March 2021, down from 143 (1%) in March 2020, up from 97 (46%) in March 2019; Active Listings were at 446 at month end compared to 408 at that time last year and 425 at the end of February; New Listings in March were up 17% compared to February 2024, up 3% compared to March 2023, down 32% compared to March 2022, down 47% compared to March 2021, up 11% compared to March 2020, and down 16% compared to March 2019. Month’s supply of total residential listings is down to 3 month’s supply (seller’s market conditions) and sales to listings ratio of 58% compared to 52% in February 2024, 55% in March 2023, and 59% in March 2022.

Month-over-month, the house price index is up 0.8% and in the last 6 months down 0.4%.

New Westminster: Total Units Sold in March were 108 - up from 79 (37%) in February, up from 54 (100%) in January, down from 204 (47%) in March 2023, down from 204 (47%) in March 2022, down from 245 (57%) in March 2021, down from 118 (8%) in March 2020, up from 81 (33%) in March 2019; Active Listings were at 350 at month end compared to 229 at that time last year and 300 at the end of February; New Listings in March were up 11% compared to February 2024, up 50% compared to March 2023, down 18% compared to March 2022, down 37% compared to March 2021, up 7% compared to March 2020, and up 4% compared to March 2019. Month’s supply of total residential listings is down to 3 month’s supply (seller’s market conditions) and sales to listings ratio of 51% compared to 41% in February 2024, 68% in March 2023, and 79% in March 2022.

Active listings up 52% year-over-year, with sales up over last month and March 2023. Month-over-month, the house price index is up 3.4% and in the last 6 months up 0.9%.

Coquitlam: Total Units Sold in March were 235 - up from 189 (24%) in February, up from 112 (110%) in January, up from 196 (20%) in March 2023, down from 400 (41%) in March 2022, down from 462 (49%) in March 2021, down from 202 (16%) in March 2020, up from 142 (65%) in March 2019; Active Listings were at 683 at month end compared to 473 at that time last year and 599 at the end of February; New Listings in March were up 15% compared to February 2024, up 39% compared to March 2023, down 30% compared to March 2022, down 32% compared to March 2021, up 9% compared to March 2020, and up 3% compared to March 2019. Month’s supply of total residential listings is steady at 3 month’s supply (seller’s market conditions) and sales to listings ratio of 55% compared to 51% in February 2024, 64% in March 2023, and 66% in March 2022.

Sales up year-over-year and month-over-month, with condo new listings up 47% to last year and townhomes new listings up 88%. Over half the condo actives are new or near new. Opportunities in this market. Month-over-month, the house price index is up 0.5% and in the last 6 months down 0.1%.

Port Moody: Total Units Sold in March were 45 - down from 46 (2%) in February, up from 31 (45%) in January, down from 80 (44%) in March 2023, down from 107 (58%) in March 2022, down from 134 (66%) in March 2021, down from 54 (17%) in March 2020, up from 38 (18%) in March 2019; Active Listings were at 160 at month end compared to 178 at that time last year and 131 at the end of February; New Listings in March were up 30% compared to February 2024, down 8% compared to March 2023, down 28% compared to March 2022, down 42% compared to March 2021, up 1% compared to March 2020, and up 11% compared to March 2019. Month’s supply of total residential listings is up to 4 month’s supply (seller’s market conditions) and sales to listings ratio of 43% compared to 57% in February 2024, 70% in March 2023, and 71% in March 2022.

Condo sales down the most in this market compared to 2023. Month-over-month, the house price index is up 0.5% and in the last 6 months down 1.5%.

Port Coquitlam: Total Units Sold in March were 89 - up from 64 (39%) in February, up from 43 (107%) in January, up from 69 (29%) in March 2023, down from 141 (37%) in March 2022, down from 205 (57%) in March 2021, down from 96 (7%) in March 2020, up from 59 (51%) in March 2019; Active Listings were at 213 at month end compared to 160 at that time last year and 198 at the end of February; New Listings in March were down 6% compared to February 2024, up 10% compared to March 2023, down 33% compared to March 2022, down 56% compared to March 2021, down 1% compared to March 2020, and down 17% compared to March 2019. Month’s supply of total residential listings is down to 2 month’s supply (seller’s market conditions) and sales to listings ratio of 64% compared to 43% in February 2024, 54% in March 2023, and 67% in March 2022.

Townhome and condo sales are up significantly from March 2023 with few condo actives listings available year-over-year. Month-over-month, the house price index is down 0.4% and in the last 6 months down 0.6%.

Pitt Meadows: Total Units Sold in March were 29 - up from 23 (26%) in February, up from 20 (45%) in January, up from 28 (4%) in March 2023, down from 55 (47%) in March 2022, down from 53 (45%) in March 2021, down from 35 (17%) in March 2020, up from 24 (21%) in March 2019; Active Listings were at 66 at month end compared to 69 at that time last year and 64 at the end of February; New Listings in March were down 7% compared to February 2024, down 2% compared to March 2023, down 48% compared to March 2022, down 46% compared to March 2021, down 36% compared to March 2020, and down 24% compared to March 2019. Month’s supply of total residential listings is down to 2 month’s supply (seller’s market conditions) and sales to listings ratio of 69% compared to 51% in February 2024, 65% in March 2023, and 67% in March 2022.

Month-over-month, the house price index is up 3.1% and in the last 6 months up 2.8%.

Maple Ridge: Total Units Sold in March were 187 - up from 145 (29%) in February, up from 106 (76%) in January, up from 149 (26%) in March 2023, down from 264 (29%) in March 2022, down from 437 (64%) in March 2021, up from 170 (10%) in March 2020, up from 116 (61%) in March 2019; Active Listings were at 714 at month end compared to 495 at that time last year and 678 at the end of February; New Listings in March were down 7% compared to February 2024, up 42% compared to March 2023, down 15% compared to March 2022, down 32% compared to March 2021, up 25% compared to March 2020, and up 46% compared to March 2019. Month’s supply of total residential listings is down to 4 month’s supply (seller’s market conditions) and sales to listings ratio of 50% compared to 36% in February 2024, 54% in March 2023, and 60% in March 2022.

Month-over-month, the house price index is up 1.6% and in the last 6 months down 1.6%.

Ladner: Total Units Sold in March were 30 - up from 23 (30%) in February, up from 21 (43%) in January, down from 38 (21%) in March 2023, down from 46 (35%) in March 2022, down from 104 (71%) in March 2021, down from 32 (6%) in March 2020, up from 25 (20%) in March 2019; Active Listings were at 90 at month end compared to 100 at that time last year and 82 at the end of February; New Listings in March were up 43% compared to February 2024, down 23% compared to March 2023, down 27% compared to March 2022, down 60% compared to March 2021, up 21% compared to March 2020, and down 31% compared to March 2019. Month’s supply of total residential listings is down to 3 month’s supply (seller’s market conditions) and sales to listings ratio of 57% compared to 62% in February 2024, 55% in March 2023, and 63% in March 2022.

Month-over-month, the house price index is up 3.4% and in the last 6 months down 1.7%.

Tsawwassen: Total Units Sold in March were 34 - down from 38 (11%) in February, up from 24 (42%) in January, down from 35 (3%) in March 2023, down from 78 (56%) in March 2022, down from 106 (68%) in March 2021, down from 39 (13%) in March 2020, up from 15 (127%) in March 2019; Active Listings were at 172 at month end compared to 169 at that time last year and 156 at the end of February; New Listings in March were down 5% compared to February 2024, down 13% compared to March 2023, down 25% compared to March 2022, down 49% compared to March 2021, down 5% compared to March 2020, and down 16% compared to March 2019. Month’s supply of total residential listings is up to 5 month’s supply (balanced market conditions) and sales to listings ratio of 48% compared to 51% in February 2024, 43% in March 2023, and 82% in March 2022.

Month-over-month, the house price index is up 3.3% and in the last 6 months down 0.7%.

Fraser Valley: Sales in March were up 13.0%, compared to February and were down 10.0% from March 2023. New listings were up 6.8% from February and up 16.7% from March 2023.The average price was up 4.5% month-over-month and is up 9.2% year-over-year. Active listings were up 11.4% to 6,197 from 5,561 last month and up 36.7% from March 2023 which was at 4,533. Active listings continue to be on the rise after being at a low of 1,735 in December 2021. Month-over-month, the house price index is up 1.3% and in the last 6 months down 2.0%.

“With inventory building, buyers now have more opportunities in both the detached and attached markets compared to one year ago,” said Jeff Chadha, Chair of the Fraser Valley Real Estate Board. “However, despite increased options, some buyers may still be waiting on the sidelines for the financing landscape to further settle before they feel comfortable getting back into the market.”

Kevin Skipworth, Partner/Broker and Chief Economist at Dexter Realty